Summary –

In this blog, we will explore Monika Halan’s expert advice on achieving financial independence and taking control of your financial future. With insights from her best-selling book Let’s Talk Money, she emphasizes the importance of financial literacy and making informed decisions. Whether you’re starting your financial journey or looking to level up, Monika’s tips offer practical steps for securing your financial well-being.

Hello readers! I’m Adesh from Finance Grow Kar and I’m thrilled to announce a new series of podcast texts I’ll be sharing with you. This series will feature insightful conversations with some of the most respected finance experts and mentors. If you’ve missed watching any of the full podcast videos, don’t worry! I’ve got you covered with detailed summaries, key takeaways, and advice that you can easily implement in your financial journey.

Today, I’m starting with an episode that was incredibly popular a year ago, and the response was absolutely fantastic. I’m talking about Monika Halan, India’s first personal finance journalist and an expert who has helped millions make informed money decisions.

💡 Financial Independence with Monika Halan 💡

In this episode, Monika Halan discusses a variety of topics related to personal finance, including the evolution of India’s financial markets, the importance of financial literacy, and tips on achieving financial independence. Monika also touches on the role of women in finance and why it’s crucial for them to take charge of their financial futures.

If you haven’t watched the full podcast yet, make sure to check it out here: Watch the full podcast with Monika Halan.

📚 Meet Monika Halan: India’s First Personal Finance Journalist 📚

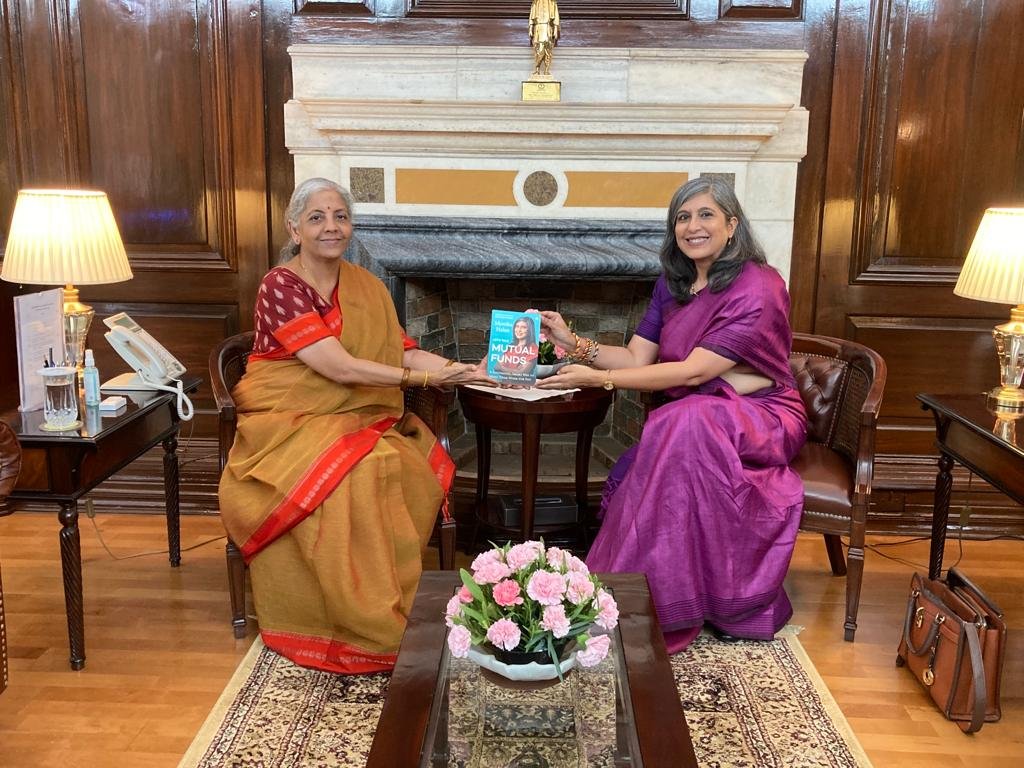

Monika Halan is a well-known personal finance writer, speaker, and author who has been at the forefront of educating Indian families on how to make better money decisions. She is the best-selling author of Let’s Talk Money, which is now available in Hindi, Marathi, and Punjabi.

Monika is also the founder of Dhan Chakra Financial Education and serves as an Adjunct Professor at the National Institute of Securities Markets (NISM), a Sebi-founded educational institution. She is the Chairperson of the SEBI Advisory Committee for Investor Protection and Education Fund, making her one of India’s top financial thought leaders.

You can explore more about her work and resources on her official website: Monika Halan.

📊 Key Highlights from the Podcast with Monika Halan 📊

-

Monika’s Career Journey 🚀

Monika’s career in personal finance started in the 1990s when personal finance was almost non-existent in India. She worked as a business journalist at The Economic Times and began exploring personal finance, a topic that was unheard of in mainstream media at the time. Through her background in economics, she used Excel sheets to calculate the impact of long-term investments like PPF (Public Provident Fund). This simple yet powerful exercise showed the magic of compounding interest.

-

The Evolution of Indian Financial Markets 🔄

Monika observed firsthand how India’s financial markets evolved over the years. In the early days, people mostly invested in FDs, gold, real estate, and insurance. Then came the rise of mutual funds and the elimination of front-end commissions in 2009. This reform, led by SEBI, revolutionized the mutual fund industry in India, making it more accessible and investor-friendly.

Today, India’s financial market is one of the most efficient and regulated in the world.

-

FIRE – Financial Independence, Retire Early 🔥

The concept of FIRE has gained momentum in recent years, with many people aiming to achieve financial independence and retire early. But how do you determine if you’re on the right track? Monika suggests calculating the ideal retirement corpus based on your current spending habits and projecting them for the future.

Here’s how Monika breaks it down:

- At 40, aim for 3 times your annual income.

- At 50, aim for 6 times.

- By 60, aim for 8 times your annual income.

These numbers will give you a rough estimate of how much you need to retire comfortably. Additionally, you can use inflation calculators to adjust your savings for the future.

-

The Importance of NPS, PPF, and EPF in Long-Term Investing 📌

Monika discusses the importance of traditional instruments like PPF, EPF, and NPS in long-term investing. She believes that these should form the core of your portfolio. While NPS is an excellent option, she warns about the mandatory annuity requirement, which could be a downside for many retirees.

-

Who Manages Money in Monika’s Family? 👨👩👧👦

Monika is the primary financial decision-maker in her family. However, over time, her husband has become more involved in managing finances. This joint participation is crucial to ensure that both partners are aware of their family’s financial status and can make informed decisions.

-

The Slow Rise of Women in Finance 👩👧

One of the biggest challenges Monika has seen is the lack of female participation in managing finances. Women often feel disconnected from money decisions because, historically, men have handled the finances. However, Monika emphasizes that it’s crucial for women to start asking questions about their financial assets and take ownership of their financial future.

She encourages women to get involved, even if it’s just by asking simple questions like:

- What assets do we own?

- Who holds the paperwork?

- Are the assets in my name?

This is essential to ensure financial security, especially in the event of unexpected life events.

💡 Takeaways for Achieving Financial Independence 💡

- Start early: The sooner you start saving and investing, the better. Even small amounts today can grow into a substantial corpus in the future.

- Invest in the right products: Focus on safe, long-term investment instruments like PPF, EPF, and NPS.

- Track your spending: Understand your current expenses and project them for the future to calculate your retirement needs.

- Involve your family: Financial decisions should be a joint effort. Both partners should be aware of where the money is going.

- Educate your children: Teach kids about money and investing at an early age. They will learn by observing your habits.

📝 Final Thoughts 📝

Achieving financial independence is not about just accumulating wealth; it’s about planning your future so that money serves you and not the other way around. Whether you’re in your 20s, 30s, 40s, or 50s, it’s never too late to start making smarter financial decisions.

Monika Halan’s insights provide a roadmap for anyone looking to take control of their finances and build a secure financial future. You can watch the full podcast and get more wisdom from her directly: Watch here.

Stay tuned for more insightful podcasts, blogs, and expert advice on personal finance. I’ll be posting more blog series to help you on your path to financial freedom. Don’t forget to visit Finance Grow Kar for more amazing content on financial topics.

Thanks for reading and remember to make your financial goals a reality! 💸

Er. Adesh Saxena is a Computer Science engineer, corporate trainer, and speaker with 14+ years of experience in digital marketing, IT, BFSI, data, and cybersecurity. In 2020, he faced a financial loss of over ₹1 crore, which changed his life. Determined to rebuild, he learned wealth-building strategies from top finance experts. Now, through FinanceGrowKar.com, he shares practical money lessons to help others grow financially.